Intrinsic Valuation with AI

Learn how to leverage Finyna to perform sophisticated intrinsic valuation analysis

Introduction to Intrinsic Valuation

Intrinsic valuation is a method to determine the true value of an investment based on its fundamentals rather than its current market price. It involves analyzing financial statements, growth prospects, risk factors, and industry conditions to calculate what an asset should be worth.

Finyna can help you perform complex intrinsic valuations for stocks and other assets using various methods, including Discounted Cash Flow (DCF) analysis, dividend discount models, and more.

How to Use Finyna for Valuation

Below are examples of effective prompts for different valuation scenarios, along with sample responses from our AI assistant. These examples demonstrate how to structure your queries to get the most useful valuation insights.

Basic Intrinsic Valuation

I'd be happy to help you with an intrinsic valuation for Techcorp Inc. To perform a thorough analysis, I'll need some information and assumptions. Let's approach this step by step:

-

Gathering Financial Data: First, I'll need Techcorp Inc.'s latest financial statements and historical performance.

-

Revenue and Growth Projections: What growth rate do you expect for Techcorp Inc. over the next 5-10 years? This is especially important given Techcorp Inc.'s position in the expanding EV market.

-

Margin Expectations: What do you expect for Techcorp Inc.'s future operating margins as the company matures?

-

Capital Expenditure Needs: Techcorp Inc. is still in growth mode, requiring significant investment in factories and technologies.

-

Discount Rate: What rate would you like to use to discount future cash flows? This should reflect Techcorp Inc.'s risk profile.

Would you like me to proceed with some standard assumptions, or do you have specific inputs for any of these parameters?

Great, I'll perform an intrinsic valuation for Techcorp using standard assumptions. Here's my approach:

Techcorp Intrinsic Valuation Analysis

Key Assumptions:

- Revenue Growth Rate: Starting at 25% and gradually decreasing to 7% over 10 years

- Operating Margin: Starting at 16% and improving to 18% long-term

- Effective Tax Rate: 20%

- Capital Expenditure: 8% of revenue, decreasing to 5% over time

- Working Capital: 3% of incremental revenue

- Discount Rate (WACC): 9%

- Terminal Growth Rate: 3%

Projected Free Cash Flows (in millions USD)

| Year | Revenue | Growth | EBIT Margin | EBIT | Tax | NOPAT | CapEx | Δ Working Capital | FCF |

|---|---|---|---|---|---|---|---|---|---|

| 2023 | $96,773 | - | 16.0% | $15,484 | $3,097 | $12,387 | $7,742 | - | $4,645 |

| 2024 | $120,966 | 25.0% | 16.5% | $19,959 | $3,992 | $15,967 | $9,677 | $726 | $5,564 |

| 2025 | $145,160 | 20.0% | 17.0% | $24,677 | $4,935 | $19,742 | $11,613 | $726 | $7,403 |

| 2026 | $168,385 | 16.0% | 17.5% | $29,467 | $5,893 | $23,574 | $12,629 | $697 | $10,248 |

| 2027 | $191,960 | 14.0% | 18.0% | $34,553 | $6,911 | $27,642 | $13,437 | $708 | $13,497 |

| 2028 | $214,995 | 12.0% | 18.0% | $38,699 | $7,740 | $30,959 | $12,900 | $690 | $17,369 |

Note: Table continues with years 2029-2033

Valuation Summary

Discounted FCF (2024-2033): 356.2 billion

Discounted Terminal Value: 238.2 billion

Less: Net Debt: -253.3 billion

Shares Outstanding: 3.18 billion

Intrinsic Value per Share: $79.65

Sensitivity Analysis

I've also analyzed how the share price varies with different assumptions:

- Higher Growth Scenario (+2% growth rate): $96.20 per share

- Lower Growth Scenario (-2% growth rate): $65.48 per share

- Higher Margin Scenario (+2% margin): $92.37 per share

- Lower Discount Rate (8%): $93.14 per share

Would you like me to elaborate on any specific aspect of this analysis or adjust any of the assumptions?

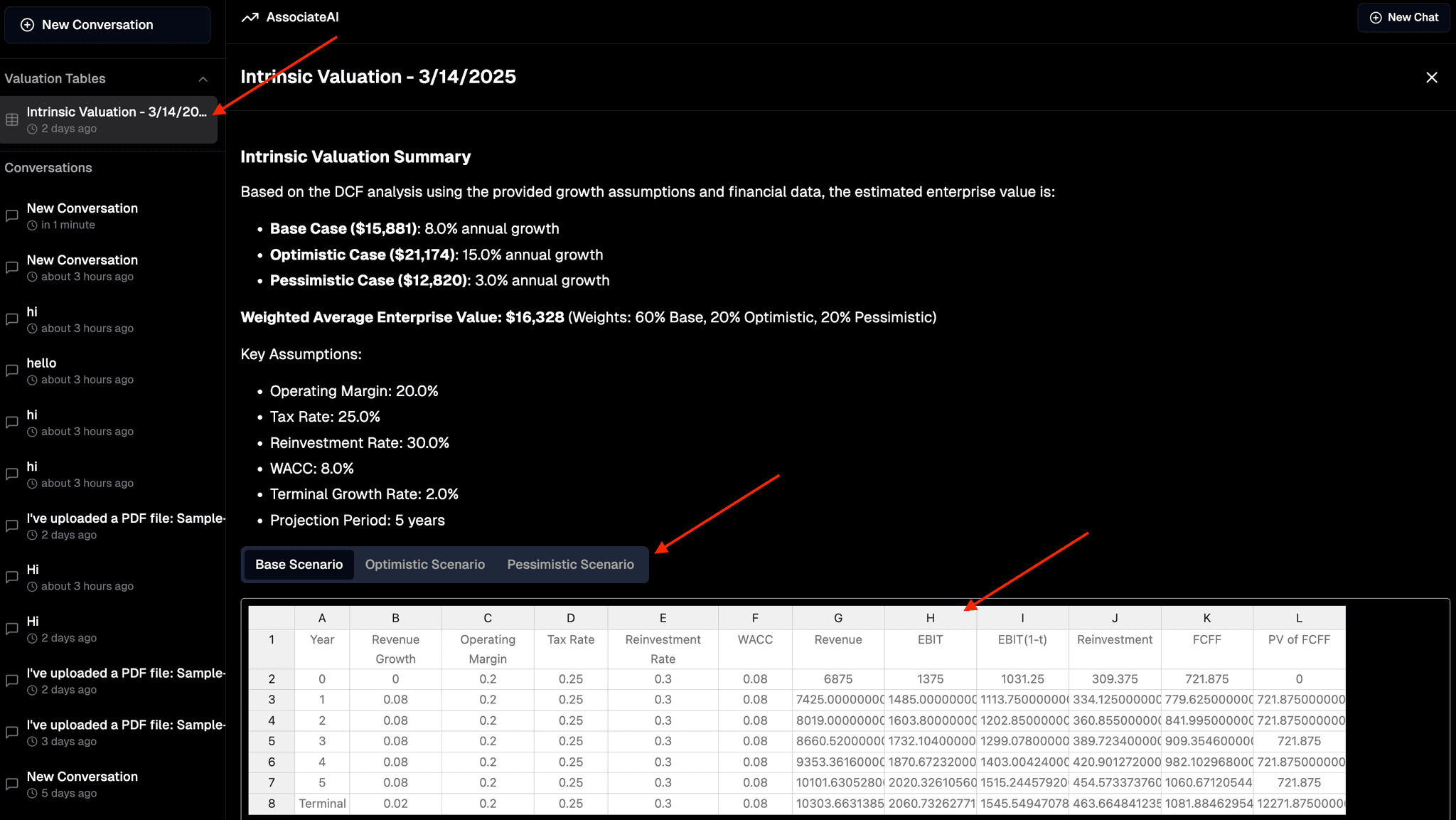

Automatically generated Excel sheet

In addition to a summary in chat, the AI assistant will automatically generate an Excel sheet with the valuation analysis. You can find the sheet either linked from the chat directly, or in the sidebar.

Advanced Valuation Methods

Beyond basic DCF analysis, there are several other approaches that can be used for intrinsic valuation. These include multiple-based methods and real options valuation for companies with significant growth potential.

When dealing with high-growth companies or those in emerging industries, traditional valuation metrics may not fully capture the potential value. In these cases, scenario analysis becomes particularly valuable.

In this advanced scenario analysis example, we have even more advanced assumptions. We're not only modifying the growth rate, but also the terminal growth rate, the WACC, and the R&D and CapEx as a percentage of revenue.

The AI assistant is able to handle project cashflows with these variables and provide a detailed analysis.

Advanced Scenario Analysis

I'd be happy to show you how to perform a scenario analysis for Apple (AAPL) with three distinct scenarios. This is a powerful way to account for uncertainty in your valuation. Here's how I'll approach it:

Apple (AAPL) Scenario Analysis

I'll develop three scenarios: Base Case, Optimistic Case, and Pessimistic Case. For each, I'll adjust key assumptions to reflect different possible futures for Apple.

Key Assumptions Across Scenarios

| Parameter | Pessimistic | Base | Optimistic |

|---|---|---|---|

| Revenue Growth (5yr avg) | 4% | 8% | 12% |

| Terminal Growth | 2% | 3% | 4% |

| EBIT Margin | 28% | 31% | 34% |

| WACC | 9.5% | 8.5% | 7.5% |

| R&D (% of Revenue) | 8% | 7% | 6% |

| CapEx (% of Revenue) | 6% | 5% | 4% |

Scenario Narratives

Base Case: Apple maintains solid growth in its core iPhone business while successfully expanding services. New product categories contribute modestly to overall growth.

Optimistic Case: Apple achieves breakthrough success in new categories (AR/VR, automotive), services growth accelerates, and iPhone market share expands in emerging markets.

Pessimistic Case: Increasing competition erodes iPhone margins, services growth slows, and new product initiatives fail to gain significant traction.

Valuation Results

| Metric | Pessimistic | Base | Optimistic |

|---|---|---|---|

| Enterprise Value | $1.85T | $2.41T | $3.24T |

| Equity Value | $1.95T | $2.51T | $3.34T |

| Share Price | $125.80 | $162.30 | $215.90 |

| Probability | 25% | 50% | 25% |

Probability-Weighted Valuation

By assigning probabilities to each scenario, we can calculate a probability-weighted share price:

162.30 × 50% + 166.58**

This represents our expected fair value considering all three scenarios.

Would you like me to provide more detail on any specific aspect of this analysis? I can also modify the assumptions or add additional scenarios if you'd prefer.

Conclusion: Effective Valuation Practices

When using Finyna for intrinsic valuation:

- Be specific about your assumptions: Clearly state your growth, margin, and discount rate assumptions.

- Consider multiple scenarios: Always evaluate bull, bear, and base cases.

- Ask for sensitivity analysis: Understand how changes in key variables affect valuation.

- Request visualization: Charts and tables can help interpret complex financial data.

- Combine methods: Use multiple valuation approaches to triangulate a reasonable value range.

Remember that intrinsic valuation is both art and science. While Finyna can perform the complex calculations, your industry knowledge and strategic insight remain essential to interpreting the results appropriately.

Finyna Financial Team

Financial analysis and AI expert at Finyna. Specializing in creating AI-powered tools for financial professionals.